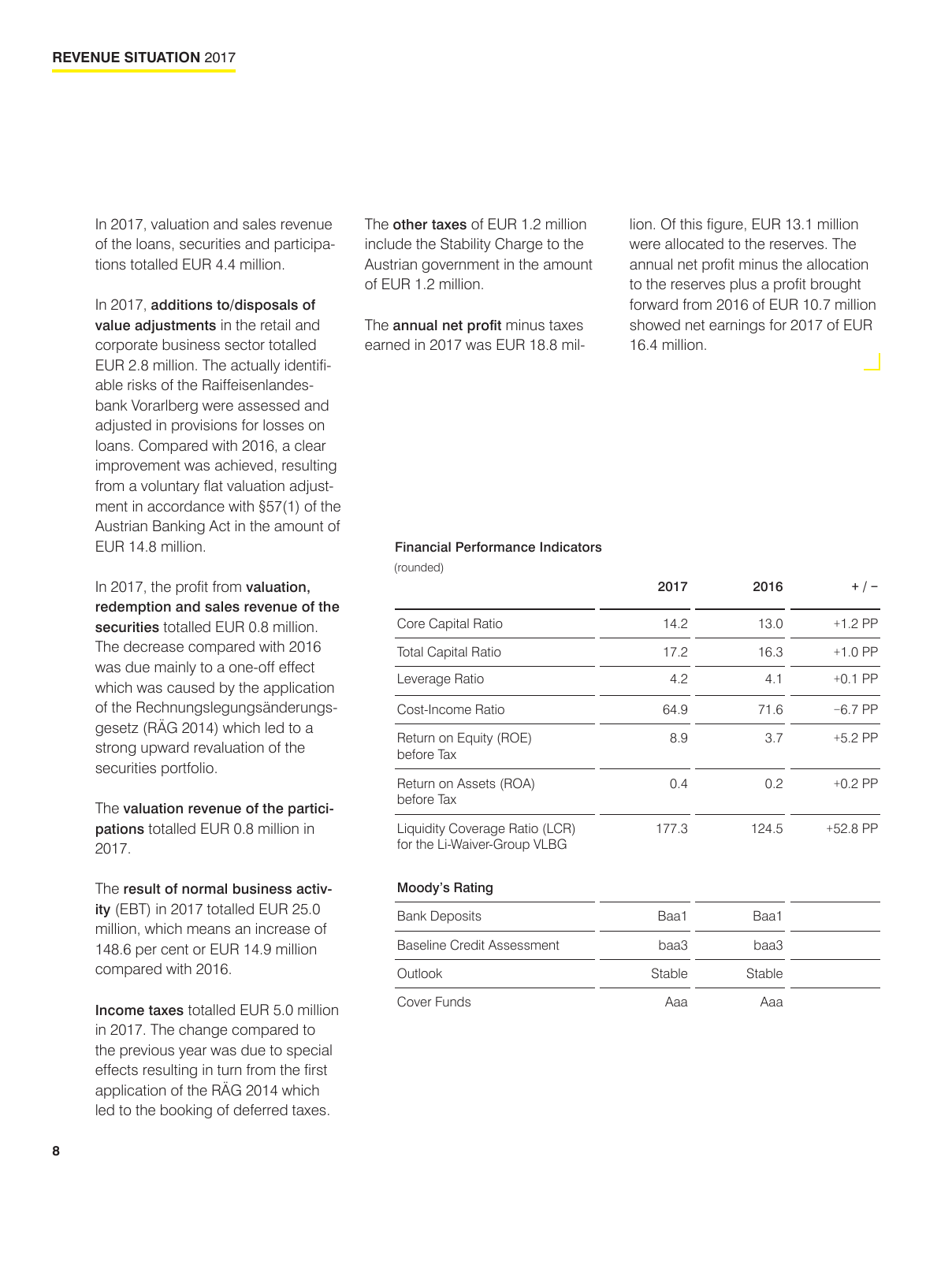

82017 2016 Core Capital Ratio 14 2 13 0 1 2 PP Total Capital Ratio 17 2 16 3 1 0 PP Leverage Ratio 4 2 4 1 0 1 PP Cost Income Ratio 64 9 71 6 6 7 PP Return on Equity ROE before Tax 8 9 3 7 5 2 PP Return on Assets ROA before Tax 0 4 0 2 0 2 PP Liquidity Coverage Ratio LCR for the Li Waiver Group VLBG 177 3 124 5 52 8 PP Moody s Rating Bank Deposits Baa1 Baa1 Baseline Credit Assessment baa3 baa3 Outlook Stable Stable Cover Funds Aaa Aaa Financial Performance Indicators rounded REVENUE SITUATION 2017 In 2017 valuation and sales revenue of the loans securities and participa tions totalled EUR 4 4 million In 2017 additions to disposals of value adjustments in the retail and corporate business sector totalled EUR 2 8 million The actually identifi able risks of the Raiffeisenlandes bank Vorarlberg were assessed and adjusted in provisions for losses on loans Compared with 2016 a clear improvement was achieved resulting from a voluntary flat valuation adjust ment in accordance with 57 1 of the Austrian Banking Act in the amount of EUR 14 8 million In 2017 the profit from valuation redemption and sales revenue of the securities totalled EUR 0 8 million The decrease compared with 2016 was due mainly to a one off effect which was caused by the application of the Rechnungslegungsänderungs gesetz RÄG 2014 which led to a strong upward revaluation of the securities portfolio The valuation revenue of the partici pations totalled EUR 0 8 million in 2017 The result of normal business activ ity EBT in 2017 totalled EUR 25 0 million which means an increase of 148 6 per cent or EUR 14 9 million compared with 2016 Income taxes totalled EUR 5 0 million in 2017 The change compared to the previous year was due to special effects resulting in turn from the first application of the RÄG 2014 which led to the booking of deferred taxes The other taxes of EUR 1 2 million include the Stability Charge to the Austrian government in the amount of EUR 1 2 million The annual net profit minus taxes earned in 2017 was EUR 18 8 mil lion Of this figure EUR 13 1 million were allocated to the reserves The annual net profit minus the allocation to the reserves plus a profit brought forward from 2016 of EUR 10 7 million showed net earnings for 2017 of EUR 16 4 million

Hinweis: Dies ist eine maschinenlesbare No-Flash Ansicht.

Klicken Sie hier um zur Online-Version zu gelangen.

Klicken Sie hier um zur Online-Version zu gelangen.