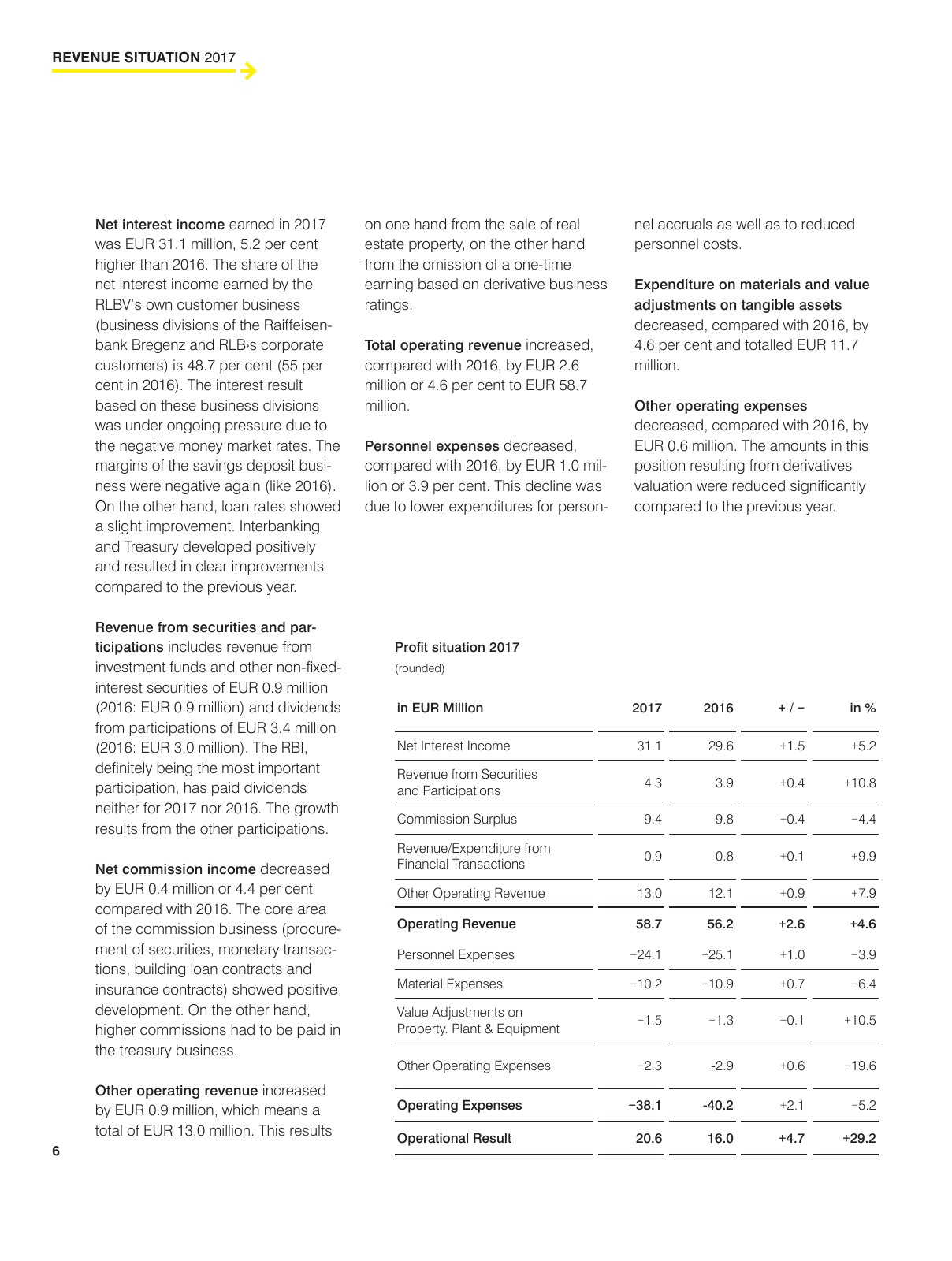

6in EUR Million 2017 2016 in Net Interest Income 31 1 29 6 1 5 5 2 Revenue from Securities and Participations 4 3 3 9 0 4 10 8 Commission Surplus 9 4 9 8 0 4 4 4 Revenue Expenditure from Financial Transactions 0 9 0 8 0 1 9 9 Other Operating Revenue 13 0 12 1 0 9 7 9 Operating Revenue 58 7 56 2 2 6 4 6 Personnel Expenses 24 1 25 1 1 0 3 9 Material Expenses 10 2 10 9 0 7 6 4 Value Adjustments on Property Plant Equipment 1 5 1 3 0 1 10 5 Other Operating Expenses 2 3 2 9 0 6 19 6 Operating Expenses 38 1 40 2 2 1 5 2 Operational Result 20 6 16 0 4 7 29 2 Profit situation 2017 rounded REVENUE SITUATION 2017 Net interest income earned in 2017 was EUR 31 1 million 5 2 per cent higher than 2016 The share of the net interest income earned by the RLBV s own customer business business divisions of the Raiffeisen bank Bregenz and RLB s corporate customers is 48 7 per cent 55 per cent in 2016 The interest result based on these business divisions was under ongoing pressure due to the negative money market rates The margins of the savings deposit busi ness were negative again like 2016 On the other hand loan rates showed a slight improvement Interbanking and Treasury developed positively and resulted in clear improvements compared to the previous year Revenue from securities and par ticipations includes revenue from investment funds and other non fixed interest securities of EUR 0 9 million 2016 EUR 0 9 million and dividends from participations of EUR 3 4 million 2016 EUR 3 0 million The RBI definitely being the most important participation has paid dividends neither for 2017 nor 2016 The growth results from the other participations Net commission income decreased by EUR 0 4 million or 4 4 per cent compared with 2016 The core area of the commission business procure ment of securities monetary transac tions building loan contracts and insurance contracts showed positive development On the other hand higher commissions had to be paid in the treasury business Other operating revenue increased by EUR 0 9 million which means a total of EUR 13 0 million This results on one hand from the sale of real estate property on the other hand from the omission of a one time earning based on derivative business ratings Total operating revenue increased compared with 2016 by EUR 2 6 million or 4 6 per cent to EUR 58 7 million Personnel expenses decreased compared with 2016 by EUR 1 0 mil lion or 3 9 per cent This decline was due to lower expenditures for person nel accruals as well as to reduced personnel costs Expenditure on materials and value adjustments on tangible assets decreased compared with 2016 by 4 6 per cent and totalled EUR 11 7 million Other operating expenses decreased compared with 2016 by EUR 0 6 million The amounts in this position resulting from derivatives valuation were reduced significantly compared to the previous year

Hinweis: Dies ist eine maschinenlesbare No-Flash Ansicht.

Klicken Sie hier um zur Online-Version zu gelangen.

Klicken Sie hier um zur Online-Version zu gelangen.